The State of Markets

A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

The State of Markets: Emerging Complacency (& euphoria)

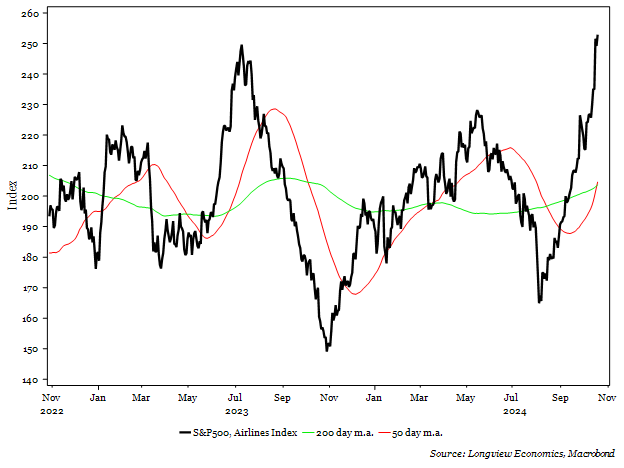

Risk appetite in markets was reasonably strong last week. In particular, US equities continued to march higher, with new record highs in the S&P500 and the DJIA (and new local highs in other indices, e.g. DJ Transports). With that, pockets of euphoria have emerged (with parabolic moves higher in airlines and financials stocks, e.g. see chart below). Other classic signs of risk appetite included the sell-off in US Treasuries (and bond proxies), as well as strength in key liquidity barometers (e.g. with new record highs in gold, and new local highs in Bitcoin).

All of which is consistent with growing complacency in markets. Illustrating that, downside put protection in portfolios was reduced again last week (with traders and investors increasingly facing the same way). The key question, therefore, is: Will that frothiness in equities keep building (for now)? Or is a pullback about to start? We outline our view on that in recent research, including in our Daily Risk Appetite publication, as well as in our Tactical Equity Asset Allocation research.

Next week’s US macro data will be watched closely and includes the Conference Board Leading Index (Monday), existing home sales (Wednesday) with new home sales and PMIs (both Services and Manufacturing) due on Thursday. There are also several speeches by key FOMC members, including Kashkari, Harker, and Barkin, amongst others. The Fed’s Beige Book is out on Wednesday and key companies reporting earnings include Tesla (Wednesday) and Amazon (Thursday). Please see below for a full list of upcoming macro data, earnings, and events.

Key chart: S&P500 airlines index, shown with 50 & 200 day moving averages

(All in London time BST)

Events: PBoC policy decision (1 & 5 year LPR, 2am).

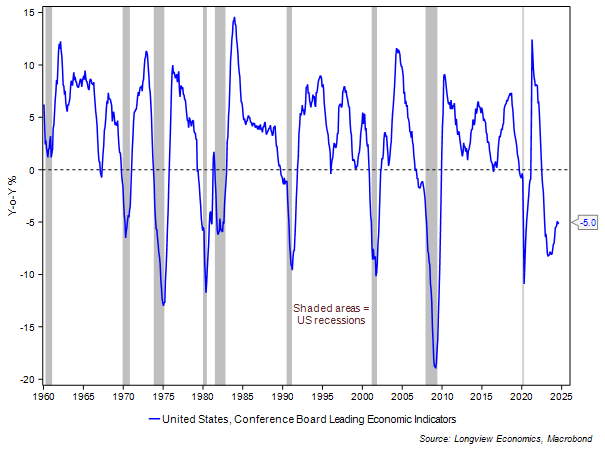

Data: German PPI (Sept, 7am); US Conference Board leading index (Sept, 3pm).

Earnings: N/A

Events: N/A

Data: N/A

Earnings: GE Aerospace, Danaher, Philip Morris, Verizon, Texas Instruments.

Events: Bank of Canada policy decision (2:45pm); speeches by the Bank of England’s Breeden & Bailey and by the ECB’s Lane, Cipollone, Escriva, Knot & Centeno at the IIF annual membership meeting (2-10pm); the ECB’s Lagarde speaks on Europe’s economic challenges at the Atlantic Council (3pm).

Data: Eurozone consumer confidence (October first estimate, 3pm); US existing home sales (Sept, 3pm).

Earnings: Tesla, Coca-Cola, T-Mobile.

Events: N/A

Data: Flash PMIs for manufacturing & service sector for Japan (1:30am), France (8:15am), Germany (8:30am), Eurozone (9am), UK (9:30am) & US (2:45pm) – all October first estimates; US new home sales (Sept, 3pm).

Earnings: Amazon, Mastercard, Caterpillar.

Events: N/A

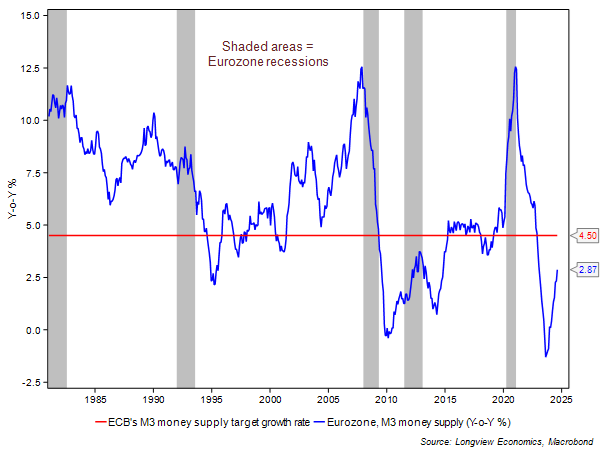

Data: Eurozone M3 money supply (Sept, 9am); US durable goods orders (September first estimate, 1:30pm).

Earnings: HCA, Natwest.

Global Macro Report, 17th October 2024:

“UK -> The Boom Drivers”

The positives for the UK economy continue to grow.

This year, it’s already delivered two quarters of consecutive quarterly GDP growth (0.7% in q1 & 0.5% in q2). These two quarters of growth come after a contraction in the second half of 2023 (fig 1) and despite the gloominess surrounding the UK economy at this present time. Much of that gloominess is being ascribed to the new Labour government (in situ since July) and their ‘talking down’ of the economy, and the need to tighten ‘fiscal’ belts to deal with the £22bn fiscal black hole (which has been upgraded to a £40bn ‘hole’ this week).

Events: Speeches by the Fed’s Logan at SIFMA annual meeting (1:55pm), Kashkari in Townhall event (6pm) & Schmid on the Economic and monetary policy outlook (10:05pm).

Data: US Conference Board leading index (Sept, 3pm).

Earnings: N/A

Events: Speech by the Fed’s Harker at Fintech conference (3pm).

Data: US Philadelphia Fed service sector activity (Oct, 1:30pm); US Richmond Fed manufacturing (Oct, 3pm).

Earnings: GE Aerospace, Danaher, Philip Morris, Verizon, Texas Instruments, Rtx Corp, Lockheed Martin, Fiserv, Sherwin-Williams, Moody’s, 3M, Freeport-McMoran, PACCAR, Norfolk Southern, General Motors, Kimberly-Clark, Baker Hughes.

Events: Bank of Canada policy decision (2:45pm); speech by the Fed’s Bowman at Fintech conference (2pm); Fed publishes Beige Book (7pm).

Data: US existing home sales (Sept, 3pm).

Earnings: Tesla, Coca-Cola, T-Mobile US, Thermo Fisher Scientific, IBM, ServiceNow Inc, NextEra Energy, AT&T, Boston Scientific, Boeing, Lam Research, General Dynamics, CME Group, Amphenol, GE Vernova LLC, O’Reilly Automotive, Waste Connections, Newmont Goldcorp, Roper Technologies, Hilton Worldwide, United Rentals, Ameriprise Financial.

Events: Speech by the Fed’s Hammack at an event hosted by the Fed & ECB (1:45pm).

Data: US Chicago Fed national activity (Sept, 1:30pm); US weekly jobless claims (1:30pm); US S&P manufacturing & service sector PMIs (October first estimate, 2:45pm); US new home sales (Sept, 3pm); US Kansas City Fed manufacturing sector activity (Oct, 4pm).

Earnings: Amazon, Mastercard, Caterpillar, S&P Global, Union Pacific, Honeywell, United Parcel Service, Northrop Grumman, Carrier Global, Arthur J Gallagher, Capital One Financial, Digital, Keurig Dr Pepper, L3Harris Technologies, Monolithic, Valero Energy, Nasdaq Inc.

Events: N/A

Data: Canadian retail sales (Aug, 1:30pm); US durable goods orders (September first estimate, 1:30pm); US Michigan sentiment (October final estimate, 3pm); US Kansas City Fed service sector activity (Oct, 4pm).

Earnings: HCA, Colgate-palmolive, Aon.

Fig B: US Conference Board leading index (Y-o-Y %)

Events: Speech by the ECB’s Simkus in Vilnius (8am).

Data: German PPI (Sept, 7am).

Earnings: Sandvik.

Events: Speeches by the ECB’s Centeno in Washington (2pm), Knot in New York (2:05pm), Holzmann in Bloomberg panel (2:45pm), Villeroy in New York (6pm) & Rehn at Peterson Institute event (7pm).

Data: Eurozone new car sales (Sept, 5am).

Earnings: L’Oreal.

Events: Speeches by the ECB’s Lagarde on Europe’s economic challenges at the Atlantic Council (3pm) & Lane, Cipollone, Escriva, Knot & Centeno participate in IIF annual membership meeting (3-8pm).

Data: Eurozone consumer confidence (October first estimate, 3pm).

Earnings: Atlas Copco, ASSA ABLOY B, DSV, Air Liquide, Iberdrola, Heineken.

Events: Speeches by the ECB’s Kazaks on ‘Global Macro Economy in a New World’ (2pm) & Lane at ‘Inflation: Drivers and Dynamics 2024’ conference (6pm).

Data: French INSEE business & manufacturing confidence (Oct, 7:45am); HCOB manufacturing & service sector PMIs for France (8:15am), Germany (8:30am) & Eurozone (9am) – all October first estimates.

Earnings: Hermes International, Vinci, Equinor, SEB A.

Events: N/A

Data: French INSEE consumer confidence (Oct, 7:45am); Spanish unemployment rate (Q3, 8am); Spanish PPI (Sept, 8am); German IFO business climate (Oct, 9am). (Oct, 9am); ECB 1 & 3 year inflation expectations (Sept, 9am); Italian ISTAT consumer & manufacturing confidence (Oct, 9am); Eurozone M3 money supply (Sept, 9am); French total jobseekers (Q3, 11am).

Earnings: Sanofi, Safran.

Fig C: : Eurozone M3 money supply (Y-o-Y %)

Events: N/A

Data: Rightmove house prices (Oct, 12:01am).

Earnings: N/A

Events: Speeches by the Bank of England’s Greene at the Atlantic Council (2:15pm), Bailey at the Bloomberg Global Regulatory Forum (2:45pm) & Breeden on cross-border payments (8:15pm).

Data: Public sector finances (Sept, 7am).

Earnings: N/A

Events: Speeches by the Bank of England’s Breeden at the IIF annual event (2pm) & Bailey at the IIF annual event (9:30pm).

Data: N/A

Earnings: Lloyds banking, Reckitt Benckiser.

Events: Speech by the Bank of England’s Mann in Washington (2pm).

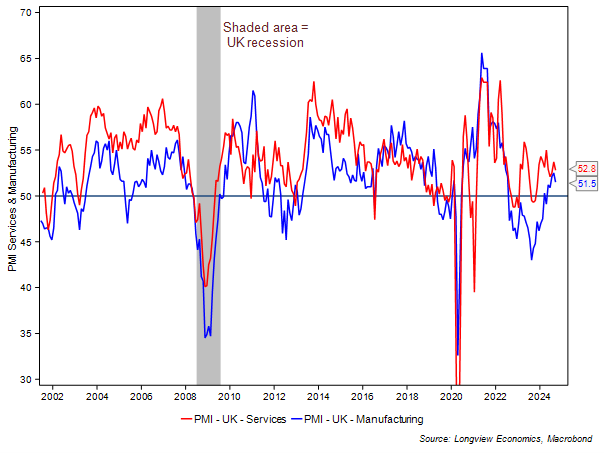

Data: S&P manufacturing & service sector PMIs (October first estimate, 9:30am); CBI industrial trends orders (Oct, 11am).

Earnings: Unilever, Relx, London Stock Exchange, Barclays.

Events: N/A

Data: GfK consumer confidence (Oct, 12:01am).

Earnings: Natwest.

Fig D: UK S&P manufacturing & service sector PMIs

Events: PBoC policy decision (1 & 5 year LPR, 2am); speech by the RBA’s Hauser at Fireside chat (2am).

Data: N/A

Earnings: UltraTech Cement.

Events: N/A

Data: N/A

Earnings: China Mobile, China Unicom Hong Kong LTD.

Events: N/A

Data: Australian Judo Bank manufacturing & service sector PMIs (October first estimate, 11pm).

Earnings: Telstra Group, HKEX.

Events: N/A

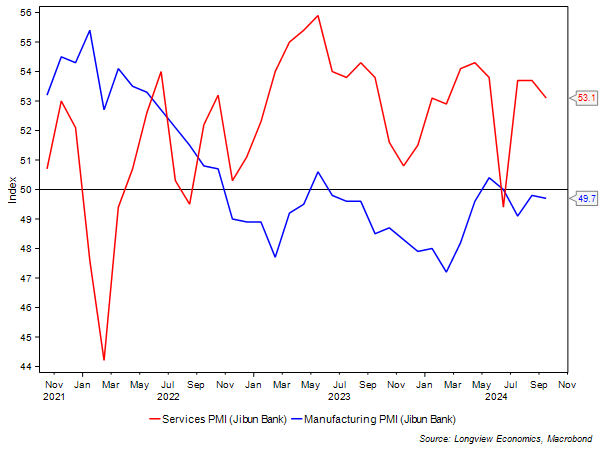

Data: Japanese Jibun Bank manufacturing & service sector PMIs (October first estimate, 1:30am); Japanese machine tool orders (September final estimate, 7am).

Earnings: CNOOC,Wesfarmers, Fortescue Metals.

Events: N/A

Data: Japanese PPI services (Sept, 12:50am); Japanese ESRI leading index (August final estimate, 6am).

Earnings: China Shenhua Energy Co.

Fig E: Japanese Jibun Bank manufacturing & service sector PMIs

Longview on Friday, 18th October 2024:

“Signs of Market Exuberance PLUS Where Have all the Fiscal Hawks Gone?” – see email attached

Global Macro Report, 17th October 2024:

“UK -> The Boom Drivers”

Global Macro Report, 14th October 2024:

“UK Housing & Credit Cycles: Turning Upwards?”

Longview on Friday, 11th October 2024:

“The (Largely) Ignored Risks (that really could matter)”

Longview ‘Tactical’ Alert No. 85, 10th October 2024:

“SELL Signals: A Full House a.k.a. Remain Cautious”

Monthly Global Asset Allocation No. 51, 7th October 2024:

“Oil Prices: Rangebound in 2025 A.k.a. Sideways Trend in Global Oil Inventories”