Next Week in Markets

Next Week in Markets: A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

The State of Markets: All Eyes on Jackson Hole (& the BRICS Summit!)

Markets continued to come under considerable pressure last week, with August’s early weakness in tech spreading demonstrably into other areas of the US and global stock market. Both the S&P500 and NDX100 closed lower on the week (-2.1% & -2.3%) marking their 3rd consecutive weekly loss (& longest losing streaks for several months). In Europe, the FTSE100 was one of the worst major European indices (down 3.5%).

China’s ongoing housing troubles added to nervousness, while the back-up in US and global bond yields was the main driver of market weakness. Importantly it was the real bond (TIPS) component of US 10 & 30-year bonds which drove the yield higher (and not the implied inflation component, which fell on the week). That triggered widespread discussion as to the cause of the back-up in those yields. Theories included: i) Too much US government debt issuance; ii) Chinese and Japanese selling of USTs; and iii) renewed strength in US data, amongst others – we assess the recent drivers of US bond yields in our latest Friday piece.

The key question for next week is whether markets bounce and stage a ‘wave 2’ relief rally (or indeed, renew their uptrend). Longview short-term market timing models (designed for 1 – 2 week moves) are increasingly suggesting that that should happen (see Daily RAG/RAG Trader for updates). Elsewhere Jackson Hole, the Fed’s annual economic symposium (Thurs – Sat) will be watched closely, along with the 15th BRICS summit (with the topic of new joiners high on the agenda). From a geopolitical aspect, the BRICS summits are becoming increasingly critical to the shape of the future, emerging multi-lateral world. The full list of next week’s key events is included below.

(All in London time BST)

Events: Chinese 1 & 5-year loan prime rates (2:15am).

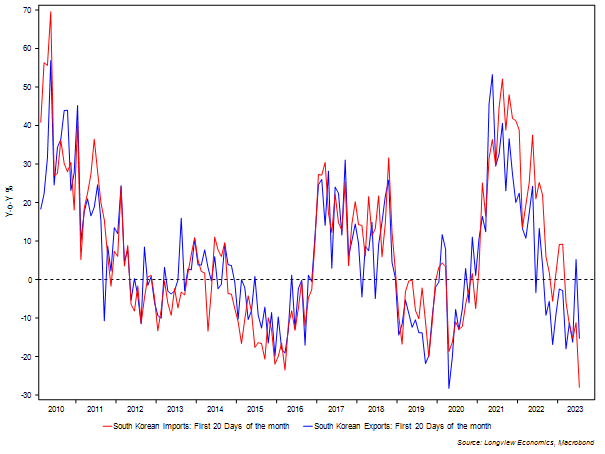

Data: South Korean 20-day imports & exports (Aug, 1am).

Earnings: N/A

Events: 15th BRICS summit, held in South Africa (Tues – Thurs).

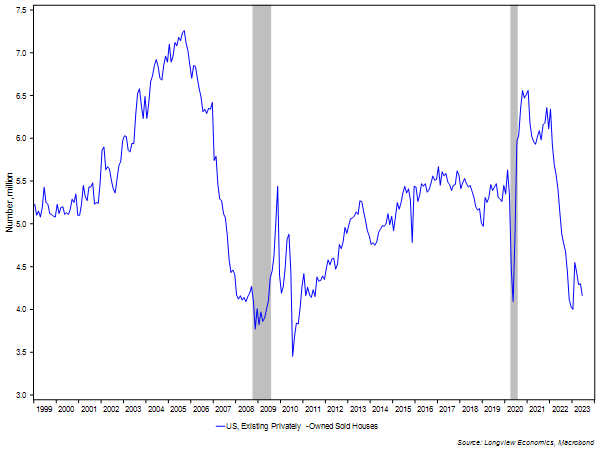

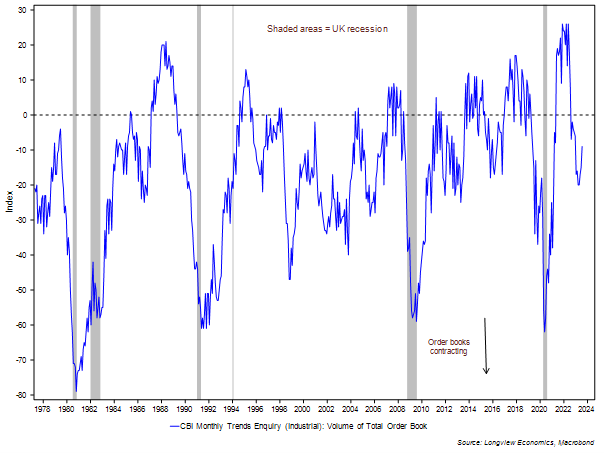

Data: US existing home sales (Jul, 3pm); UK CBI industrial trends survey (Aug, 11am).

Earnings: Zoom, Baidu.

Events: 15th BRICS summit (Tues – Thurs).

Data: S&P Global/HCOB manufacturing & service sector PMIs for France (8:15am), Germany (8:30am), EZ (9am), UK (9:30am) & US (2:45pm) – all August first estimates.

Earnings: N/A

Events: Annual 2023 Jackson Hole Policy Symposium (Thurs – Sat); 15th BRICS summit (Tues – Thurs); the Fed’s Harker interviews with CNBC (5pm).

Data: US durable goods orders (July first estimate, 1:30pm).

Earnings: RBC, Dollar Tree.

Events: Jackson Hole continues, with key speech by the Fed’s Powell (3:05pm) & the ECB’s Lagarde (8pm); the Fed’s Harker interviews with Bloomberg TV (2pm) & Yahoo Finance (2:40pm).

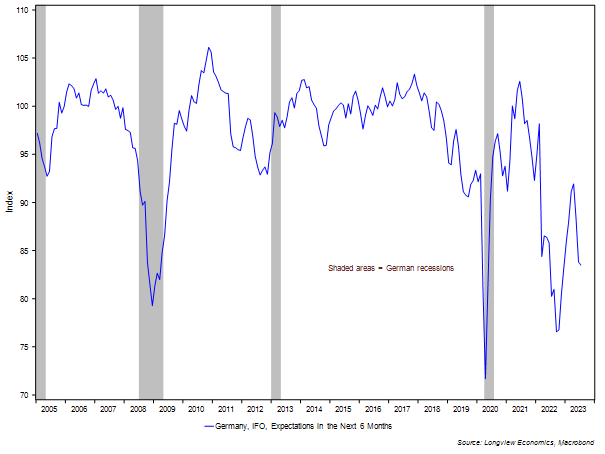

Data: German IFO current assessment & expectations (Aug, 9am).

Earnings: Marvell, Dell.

(Long)View from London, 18th July 2023:

“Only Four Things Matter – What are They? How will They Pan Out?”

Generally in markets there’s only four or so things (four key debates) that matter at any one moment. That is, there are a small number of key macro debates which, once resolved, dictate the direction of the key asset classes (equities, bonds, credit, commodities and rates), and the subsegments within those asset classes – i.e. ‘long or short duration’, ‘growth, cyclical or defensive sectors’, ‘precious or industrial metals’ , ‘high grade or high yield credit’, and so on.

As such, working out what those debates are, and their likely outcome, is critical for any investor who wants to get the big calls in markets right at any one point in time.

At this moment, it strikes us that those 4 big debates are as follows:

Monthly Commodity Update, 17th August 2023:

“Chinese Real Estate – Is Contagion Building?”

“…In the sections below, we outline all the key developments in China’s real estate market since our last update in mid-July. Overall, despite numerous (modest) attempts at supporting the real estate market – officials have remained cautious (so far). As we demonstrated last month, the decline in Chinese real estate should continue without meaningful (i.e. ‘bazooka’ like) stimulus from officials (especially given that the bubble would appear to have burst)…

…The developments also highlight the potential risks of contagion to the financial/shadow banking sector (NB Chinese wealth management products must be directly and indirectly heavily exposed to the real estate sector, given that it accounts for 30% of GDP – in forthcoming research, we will delve deeper into the risks of contagion from the decline in real estate, i.e. ‘follow the money’ trail)…”

Key Points

Real estate accounts directly and indirectly for 30% of Chinese GDP.

Developers (such as Country Garden, Wanda, Shui On Land, etc.) are missing bond payments and increasingly seeking debt restructuring.

Macro data, especially that related to property, continues to deteriorate.

Overview

In prior research, we outlined the significance of the Chinese real estate sector which accounts, directly and indirectly, for approx. 30% of Chinese GDP. The direction of that sector, therefore, is critical to the direction of the overall economy. Currently, it’s turbulent. See, for example, the sharp fall-off in real estate transactions (fig 3) or the marked contraction in property investment (-8.5% Y-o-Y YTD on latest data published this week – see fig 5), as well as the monthly contraction in new home prices.

Events: N/A

Data: N/A

Earnings: N/A

Events: Fed’s Goolsbee gives welcome remarks at a Fed Listens event on youth unemployment (7:30pm); Fed’s Goolsbee & Bowman participate in Fireside Chart (8:30pm).

Data: Philadelphia Fed non-manufacturing activity (Aug, 1:30pm); US existing home sales (Jul, 3pm); Richmond Fed manufacturing & business conditions (Aug, 3pm).

Earnings: Lowe’s, Medtronic, Zoom.

Events: N/A

Data: US weekly MBA mortgage applications (12pm); US S&P Global manufacturing & service sector PMIs (August first estimate, 2:45pm); US new home sales (Jul, 3pm).

Earnings: Analog Devices, NetEase, Snowflake, Autodesk.

Events: Annual 2023 Jackson Hole Policy Symposium begins (Thurs – Sat); the Fed’s Harker interviews with CNBC (5pm).

Data: US weekly jobless claims (1:30pm); US durable goods orders (July first estimate, 1:30pm); Kansas Fed manufacturing activity (Aug, 4pm).

Earnings: Intuit, RBC, Toronto Dominion Bank, Workday, Dollar Tree, Ulta Beauty.

Events: Annual 2023 Jackson Hole Policy Symposium continues (Thurs – Sat), with key speech by the Fed’s Powell (3:05pm); the Fed’s Harker interviews with Bloomberg TV (2pm) & Yahoo Finance (2:40pm).

Data: Michigan sentiment (August final estimate, 3pm); Kansas Fed services activity (Aug, 4pm).

Earnings: Marvell, Dell.

Events: N/A

Data: German PPI (7am).

Earnings: N/A

Events: N/A

Data: N/A

Earnings: N/A

Events: N/A

Data: HCOB manufacturing & service sector PMIs for France (8:15am), Germany (8:30pm) & EZ (9am) – all August first estimates; EZ European Commission consumer confidence (August first estimate, 3pm).

Earnings: N/A

Events: N/A

Data: French INSEE business & manufacturing confidence (Aug, 7:45am).

Earnings: CRH.

Events: Speech by ECB’s Lagarde at Jackson Hole (8pm BST).

Data: German GDP (Q2 final estimate, 7am); French consumer confidence (Aug, 7:45am); German IFO current assessment & expectations (Aug, 9am).

Earnings: N/A

Events: N/A

Data: Rightmove house prices (Aug, 12:01am).

Earnings: N/A

Events: N/A

Data: Public sector finances data (Jul, 7am); CBI industrial trends survey (Aug, 11am).

Earnings: F&C Investment Trust.

Events: N/A

Data: S&P Global/CIPS manufacturing & service sector PMIs (August first estimate, 9:30am).

Earnings: N/A

Events: N/A

Data: CBI distributive trades survey (Aug, 11am).

Earnings: N/A

Events: N/A

Data: GfK consumer confidence (Aug, 12:01am).

Earnings: N/A

Events: Chinese 1 & 5-year loan prime rates (2:15am).

Data: South Korean 20-day imports & exports (Aug, 1am).

Earnings: BHP Group.

Events: N/A

Data: South Korean household credit (Q2, 4am); Taiwan unemployment data (Jul, 9am); South Korean BoK manufacturing & non-manufacturing surveys (Sep, 10pm).

Earnings: Baidu, Anhui Conch Cement, Woodside Energy, Tongwei Group, Anta Sports.

Events: N/A

Data: Judo Bank Australian manufacturing & service sector PMIs (August first estimates, 12am); Jibun Bank Japanese manufacturing & service sector PMIs (August first estimates, 1:30am); Japanese machine tool orders (July final estimate, 7am); Taiwan industrial production (Jul, 9am).

Earnings: Xiaomi, Woolworth’s.

Events: N/A

Data: N/A

Earnings: China Life Insurance, China Construction Bank Corp, AIA Group, Ping An Bank, PDD Holdings.

Events: N/A

Data: Japanese services PPI (Jul, 12:50am).

Earnings: Meituan, China Shenhua Energy, Zijin Mining, China Citic Bank, Bank of Ningbo, Cathay Financial, Tsingtao Brewery Co.

Longview on Friday, 18th August 2023:

“Only Four Things Matter – What are They? How will They Pan Out?”

Monthly Commodity Update, 17th August 2023:

“Chinese Real Estate – Is Contagion Building?”

Recommended Global Macro Trade, 16th August 2023:

“Move LONG GOLD futures (Plus Housekeeping on Current Outstanding Trades)”

The SHORT VIEW (& market positioning), 15th August 2023:

“Extremes in Treasury & Heating Oil”

Commodity Fundamentals Report No. 162, 15th August 2023:

“The Case for BUYing Gold a.k.a. Models, Macro, BRIC Currencies & Cold War II”

Longview on Friday, 11th August 2023:

“Bond Yields, Equities, & US Recession Watch”

Commodity Fundamentals Report No. 161, 9th August 2023:

“US Shale Oil: Structural Decline Ahead”

Global Macro Report, 8th August 2023:

“Housing: Dispelling the Supply Myth - The UK & The International Comparison”