The State of Markets

A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

The State of Markets:

Concerns about ‘sticky’ US inflation continued to grow last week, reinforced by Wednesday’s stronger than expected CPI reading. That generated a further pricing out of 2024 and 2025 rate cuts; sharp moves higher in government bond yields across the curve (with US 2 year yields, for example, approaching 5%); as well as a stronger US dollar. The USDJPY, for example, broke above its key 151 key level; EURUSD fell to its weakest level since November last year; while GBPUSD is down 1.8% over in the past three trading days (Wednesday – Friday).

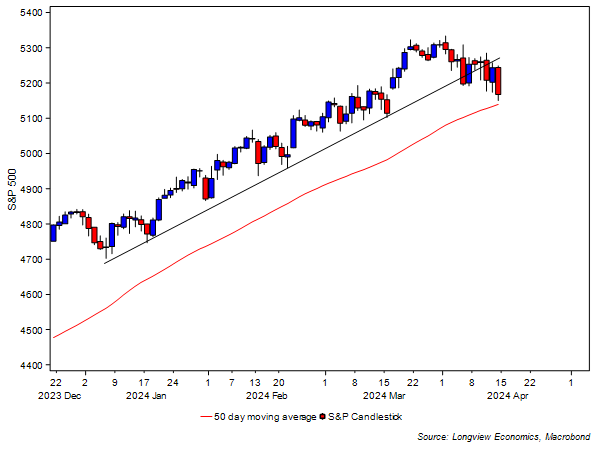

All of which put downward pressure on US and global equities. In particular, as the chart below shows, the S&P500 broke below its key trend line last week (which has been in place since January), and yesterday it tested its 50 day moving average.

The key question, therefore, is: Will the S&P500 break meaningfully below its 50 day trend line in coming days/weeks? Or will this earnings season, which began in earnest yesterday, provide support for markets? Strong earnings often act as a catalyst to drive equities higher, especially if they have traded sideways to down ahead of the start of earnings. Below we highlight key company reports due this coming week. Elsewhere, March inflation readings for the UK (Wednesday) and Japan (Friday) will also be watched closely, as will speeches by Fed Presidents (and other central bank policy makers). Please see below for a full list of key data and events.

Fig A: S&P500 futures candlestick, shown with its 50 day moving average

(All in London time BST)

Events: N/A

Data: US retail sales (Mar, 1:30pm); US NAHB homebuilders index (Apr, 3pm).

Earnings: Goldman Sachs, Charles Schwab

Events: N/A

Data: Chinese data (GDP for Q1, IP, retail sales, FAI & unemployment rate for March – all at 3am); UK employment, jobless claims & average weekly earnings (Feb, 7am).

Earnings: UnitedHealth, J&J, Bank of America, Morgan Stanley, Louis Vuitton

Events: N/A

Data: UK headline & core CPI (Mar, 7am).

Earnings: Abbott Labs, U.S. Bancorp, Volvo

Events: Speeches by the ECB’s Nagel, Lindner, Centeno, Simkus & Vujcic at Washington DC Economic Festival (1pm – 8pm).

Data: US Conference Board leading index (Mar, 3pm).

Earnings: Taiwan Semiconductors, Netflix, Blackstone, Nordea Bank

Events: N/A

Data: Japanese headline & core CPI (Mar, 12:30am); UK ONS retail sales (Mar, 7am).

Earnings: Procter&Gamble

Monthly Commodity Newsflow, 11th April 2024:

"What’s Driving Gold Prices?"

“Gold prices hit new record high on Fed cut expectations”

Source: CNBC, 1st April 2024

“Gold price hits another all-time high as Fed-fuelled rally continues”

Source: Mining.com, 1st April 2024

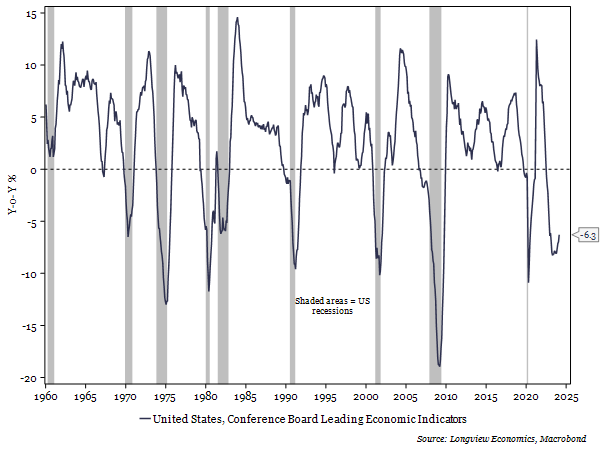

The uptrend in gold prices over the past two months has been one of the strongest rallies in over a decade (fig 2). Why the price has moved up so rapidly, however, is not obvious.

Indeed, some commentators have suggested that the move relates to growing rate cut expectations (e.g. see quotes above). However, as we show below, rate cuts have been consistently priced out over the past two months (fig 14). Likewise, gold largely managed to hold onto its gains yesterday despite the higher-than-expected CPI reading. Other traditional drivers of the gold price have also not correlated with the recent move higher. The USD and TIPS yields, for example, have been largely unchanged over the past couple months (e.g. see fig 15) while the gold price has rallied.

Events: Speech by the Fed’s Logan in Tokyo (7:30am).

Data: Canadian housing starts (Mar, 1:15pm); Canadian manufacturing & wholesale sales (Feb, 1:30pm); US Empire manufacturing (Apr, 1:30pm); US retail sales (Mar, 1:30pm); US business inventories (Fed, 3pm); US NAHB homebuilders index (Apr, 3pm).

Earnings: Goldman Sachs, Charles Schwab

Events: Fed’s Daly gives keynote remarks (1am); speech by the Fed’s Jefferson at monetary policy forum (2pm).

Data: US building permits & housing starts (Mar, 1:30pm); Canadian headline & core CPI (Mar, 1:30pm); US New York Fed services business activity (Mar, 1:30pm); US industrial & manufacturing production & capacity utilisation (Mar, 2:15pm).

Earnings: UnitedHealth, J&J, Bank of America, Morgan Stanley, PNC Financial, Interactive Brokers

Events: Fed releases Beige Book (7pm); speech by the Fed’s Mester gives an update on Fed (10:30pm) & Bowman at IIF Global Outlook Forum (11:30pm).

Data: N/A

Earnings: Abbott Labs, Progressive, Prologis, CSX, U.S. Bancorp, Travelers

Events: Speeches by Fed’s Bowman at SIFMA roundtable (2:15pm), Williams in moderated discussion (2:15pm) & Bostic in Fireside Chat on the Economy (4pm & 10:45pm)

Data: US Philadelphia Fed business outlook (Apr, 1:30pm); US Conference Board leading index (Mar, 3pm); US existing home sales (Mar, 3pm).

Earnings: Netflix, Blackstone, Intuitive Surgical, Elevance Health, Marsh McLennan

Events: Speech by Fed’s Goolsbee in Q&A (3:30pm).

Data: N/A

Earnings: Procter&Gamble, American Express

Events: Speeches by the ECB’s Simkus in Lithuania (8:30am) & Lane in Dublin (1pm).

Data: Eurozone industrial production (Feb, 10am).

Earnings: N/A

Events: Speeches by the ECB’s Rehn on the Euro area economic outlook and monetary policy (9am), Villeroy (5:30pm) & Vujcic on EU-US competitiveness (7pm).

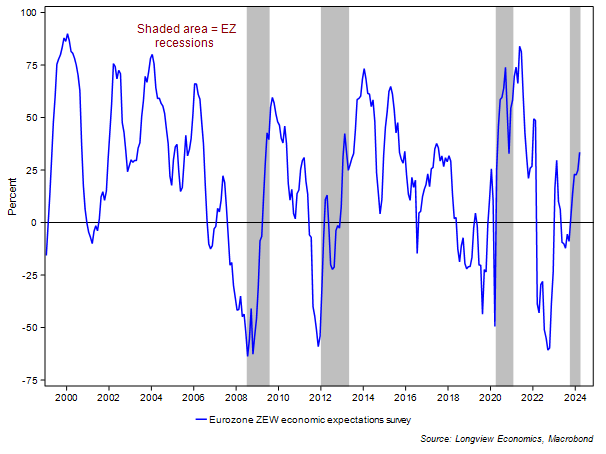

Data: German wholesale price index (Mar, 7am); Italian headline & core CPI (March final estimate, 9am); German & Eurozone ZEW survey – expectations & current situation (Apr, 10am); Eurozone trade balance (Feb, 10am).

Earnings: Louis Vuitton, Ericsson, Rio Tinto

Events: Speeches by ECB’s Cipollone at IIF Global Outlook Forum (2pm), Hernandez de Cos at IIF Global Outlook Forum (4pm) & Schnabel on monetary policy challenges during uncertain times (4:45pm)

Data: Eurozone headline & core CPI (March final estimate, 10am).

Earnings: Volvo, ASML Holding

Events: Speeches by ECB’s Guindos in Belgium (8:15am), as well as Nagel, Lindner, Centeno, Simkus & Vujcic at Washington DC Economic Festival (1pm – 8pm).

Data: Eurozone new car sales (Mar, 7am); ECB current account (Feb, 9am).

Earnings: ABB, Investor, Nordea Bank, EQT, L’Oreal, EssilorLuxottica

Events: Speech by ECB’s Nagel in Washington DC (8pm).

Data: German PPI (Mar, 7am).

Earnings: N/A

Events: Speech by the Bank of England’s Breeden on the outlook for payments innovation (12:15pm).

Data: N/A

Earnings: N/A

Events: Bank of England’s Deputy Lombardelli testifies to the Treasury Committee in Parliament (10am); speech by the Bank of England’s Bailey at the International Monetary Fund meeting (6pm).

Data: Employment, jobless claims & average weekly earnings (Feb, 7am).

Earnings: N/A

Events: Speech by the Bank of England’s Greene on global economic and risk outlook (1:05pm), Bailey in Washington (5pm) & Haskel at King’s College London (7pm).

Data: Headline & core CPI, RPI & PPI (Mar, 7am); Land Registry house prices (Feb, 9:30am).

Earnings: N/A

Events: N/A

Data: N/A

Earnings: N/A

Events: Speech by the Bank of England’s Ramsden on monetary policy responses to the post pandemic inflation (3:15pm).

Data: ONS retail sales (Mar, 7am).

Earnings: N/A

Events: N/A

Data: Japanese machinery orders (Feb, 12:50am).

Earnings: N/A

Events: N/A

Data: Chinese new home prices (Mar, 2:30am); Chinese data (GDP for Q1, IP, retail sales, FAI & unemployment rate for March – all at 3am).

Earnings: Amperex Tech

Events: N/A

Data: Japanese imports & exports (Mar, 12:50am); Australian Westpac leading index (Mar, 1:30am).

Earnings: N/A

Events: N/A

Data: Australian NAB business confidence (Q1, 2:30am); Australian employment data (Mar, 2:30am); Japanese machine tool orders (March final estimate, 7am).

Earnings: Taiwan Semiconductor, Jiangsu Hengrui

Events: N/A

Data: Japanese headline & core CPI (Mar, 12:30am).

Earnings: Wanhua Chemical

Longview on Friday, 12th April 2024:

""

Monthly Commodity Newsflow, 11th April 2024:

"What’s Driving Gold Prices?"

Monthly Global AA No. 35, 10th April 2024:

“UK Rates: More Cuts Need to be Priced"

Longview on Friday, 5th April 2024:

"US & European Inflation – What’s Next?"

Commodity Fundamentals Report No. 179, 4th April 2024:

"OIL: SELL Case Brewing"

Tactical Equity Asset Allocation No. 243, 3rd April 2024:

“Equity Uptrend Ongoing (for now)"