The State of Markets

A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

The State of Markets: “Will Lows Be Retested?”

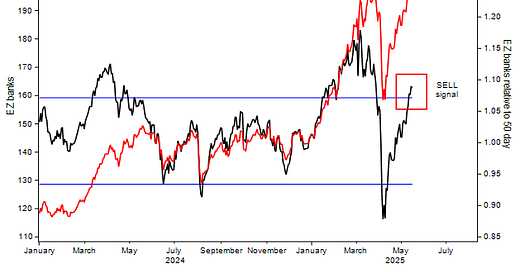

Risk appetite in global markets was strong last week. In particular, the positive tariff news last weekend (and on Monday) generated strong gains in global equities. As such, major US indices are now back at/close to their highs from late February (including the S&P500 & the NASDAQ100). Similarly in Europe various equity indices, like the German DAX, Spanish IBEX, and Italian MIB, have made new record highs this week. With that strong rally, though, signs of complacency/froth are back, and several indices are now overbought. In Europe, for example, that includes EZ banks, which are now over-extended to the upside (see chart below).

The key question, therefore, is: Will US/global equities give back some of their gains in the near term? Will they retest their lows? Or is this renewed uptrend ongoing? We address those questions in recent research (e.g. see this week’s ‘Longview on Friday’).

This coming week there’s a PMI theme, with flash May manufacturing & service sector PMIs for major economies due on Thursday (including the US, Japan, Germany, France, the Eurozone, and the UK). In the US, the Conference Board Leading Index is due on Monday, with existing and new home sales on Thursday and Friday, respectively. There will also be speeches by several Fed members next week. Elsewhere UK inflation (CPI, RPI, & PPI) is due on Wednesday. Please see below for a full list of key upcoming macro data & events.

Key chart: Eurozone banks relative to their 50-day moving average vs. EZ banks (SX7E)

(All in London time BST)

Events: N/A

Data: US Conference Board leading index (Apr, 3pm); Chinese activity data (industrial production, retail sales, fixed asset, property investment & unemployment rate – Apr, 3am).

Earnings: N/A

Events: PBOC policy decision (2am); RBA policy decision (5:30am).

Data: Eurozone consumer confidence (May first estimate, 3pm).

Earnings: N/A

Events: N/A

Data: UK Headline & core CPI, RPI & PPI (Apr, 7am);

Earnings: N/A

Events: N/A

Data: US S&P manufacturing & service sector PMIs (May first estimates, 2:45pm); US existing home sales (Apr, 3pm); HCOB manufacturing & service sector PMIs for France (8:15am), Germany (8:30am) & Eurozone (9am) – all May first estimates; German IFO business climate (May, 9am).

Earnings: N/A

Events: N/A

Data: UK Retail sales (Apr, 7am); Japanese headline & core CPI (Apr, 12:30am).

Earnings:N/A

Global Macro Report, 14th May 2025:

“Fed’s Dual Mandate (Inflation & Growth): Which Part Matters the Most? a.k.a More Cuts Need to be Priced into the Curve”

The Fed is stuck between a ‘rock and a hard place’, as it worries about higher inflation and potentially weaker growth.

The growth outlook for the US economy, though, is already deteriorating Real income growth is slowing; job creation is weaker than the recent NFP data suggests; while wage growth is slowing (and set to continue to slow).

Inflation pressures have also now largely dissipated. Traditional inflation drivers (labour, oil, etc) as well as most measures of inflation, point to low/limited price pressures. The tariffs tax, meanwhile, is not the same inflationary impulse as the one in 2020/21 (driven by aggressive money creation).

Events: Speeches by the Fed’s Bostic & Jefferson (1:30pm), Williams in moderated discussion (1:45pm) & Logan at a financial markets conference (6:15pm); market holiday in Canada on account of Victoria Day.

Data: US Conference Board leading index (Apr, 3pm).

Earnings: N/A

Events: Speech by the Fed’s Musalem on the economy (6pm).

Data: US Philadelphia Fed service sector activity (May, 1:30pm); Canadian headline & core CPI (Apr, 1:30pm).

Earnings: Home Depot, Palo Alto Networks

Events: Speeches by the Fed’s Hammack & Daly (12am).

Data: N/A

Earnings: TJX, Lowe’s, Medtronic

Events: Speech by the Fed’s Williams gives keynote remarks (7pm).

Data: Canadian CFIB business barometer (May, 12pm); US Chicago Fed national activity (Apr, 1:30pm); Canadian industrial product & raw material price index (Apr, 1:30pm); US weekly jobless claims (1:30pm); US S&P manufacturing & service sector PMIs (May first estimates, 2:45pm); US existing home sales (Apr, 3pm); US Kansas City Fed manufacturing sector activity (May, 4pm).

Earnings: Intuit, Analog Devices, Workday, Autodesk

Events: N/A

Data: Canadian retail sales (Mar, 1:30pm); US new home sales (Apr, 3pm); US Kansas City Fed service sector activity (May, 4pm).

Earnings: PDD Holdings.

Events: N/A

Data: Eurozone headline & core CPI (April final estimate, 10am).

Earnings: N/A

Events: Speeches by the ECB’s Wunsch at AFME event in Frankfurt (7:55am) & Knot on DNB’s financial stability overview (11am).

Data: German PPI (Apr, 7am); Eurozone ECB current account (Mar, 9am); Italian current account balance (Mar, 9:30am); Eurozone construction output (Mar, 10am); Eurozone consumer confidence (May first estimate, 3pm).

Earnings: N/A

Events: Speech by the ECB’s Lane on NIRP in Madrid (5pm).

Data: N/A

Earnings: N/A

Events: Speeches by the ECB’s Holzmann in Vienna (8am) & Vujcic in Croatia (9:20am); ECB publishes account of April 16-17 policy meeting.

Data: French INSEE business & manufacturing confidence (May, 7:45am); HCOB manufacturing & service sector PMIs for France (8:15am), Germany (8:30am) & Eurozone (9am) – all May first estimates; German IFO business climate (May, 9am); French retail sales (Apr).

Earnings:

Events: Speech by the ECB’s Lane in Florence (9:30am).

Data: German GDP (Q1 final estimate, 7am); French INSEE consumer confidence (May, 7:45am).

Earnings: N/A

Events: N/A

Data: Rightmove house prices (May, 12:01am).

Earnings: N/A

Events: Speech by the Bank of England’s Pill at the Barclays briefing (9am).

Data: N/A

Earnings: Vodaphone

Events: N/A

Data: Headline & core CPI, RPI & PPI (Apr, 7am); Land Registry house price index (Apr, 9:30am).

Earnings: SSE

Events: Speeches by the Bank of England’s Breeden in at the FT climate and impact event (11:50am), Dhingra (12pm) &Pill in Vienna (1:30pm).

Data: Public sector finances (Apr, 7am); S&P manufacturing & service sector PMIs (May first estimates, 9:30am); CBI industrial trends survey (May, 11am).

Earnings: BT

Events: N/A

Data: Gfk consumer confidence (May, 12:01am); Retail sales (Apr, 7am).

Earnings: N/A

Events: N/A

Data: Chinese new & used home prices (Apr, 2:30am); Chinese activity data (industrial production, retail sales, fixed asset, property investment & unemployment rate – Apr, 3am); Japanese Tertiary industry index (Mar, 5:30am).

Earnings: N/A

Events: PBOC policy decision (2am); RBA policy decision (5:30am).

Data: N/A

Earnings: Tokio Marine Holdings

Events: N/A

Data: Japanese imports/exports, & trade balance (Apr, 12:50am); Australian Westpac leading index (Apr, 1:30am).

Earnings: N/A

Events: Speech by the BOJ’s Noguchi in Miyazaki (2:30am); speech by the RBA’s Hauser (9:30am).

Data: Australian S&P manufacturing & services sector PMIs (May first estimates, 12am); Japanese machinery orders (Mar, 12:50am); Japanese Jibun Bank manufacturing & services sector PMIs (May first estimate, 1:30am); Japanese machine tool orders (April final estimate, 7am).

Earnings: N/A

Events: N/A

Data: Japanese headline & core CPI (Apr, 12:30am).

Earnings: N/A

Longview on Friday, 16th May 2025:

“To Retest or Not to Retest?”

Recommended Global Macro Trade 15th May 2025:

“Play Lower US Rates & Treasury Yields”

Global Macro Report, 14th May 2025:

“Fed’s Dual Mandate (Inflation & Growth): Which Part Matters the Most? a.k.a More Cuts Need to be Priced into the Curve”

Longview on Friday, 9th May 2025:

“Global Macro - In the 'Foothills of Sunlit Uplands'”

Commodity Fundamentals Report No. 187, 8th May 2025:

“OIL: How Low Does It Go?