The State of Markets

A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

The State of Markets: “Equity Rally: How Long Does it Last?”

US equities stayed in ‘risk on’ mode this week. That was fuelled, in particular, by strong tech earnings from Meta & Microsoft (on Wednesday), with both significantly beating expectations. As such, and with most earnings reports in (>350 of S&P500 companies), the average upside surprise has been strong (+9%, vs. the typical surprise of +4%). Other newsflow has also been encouraging for the bulls, with signs that the US & China are close to starting trade negotiations.

Major US indices have now, therefore, retraced most/all of their post ‘Liberation Day’ losses. With that strength, investors are asking: Has a new uptrend started? Will there be a re-test of the early April lows? Or, are we merely in the midst of a bear market relief rally? We outline our views on those questions in recent research (see below for detail).

Events next week may also provide some clues. All eyes will be on the Fed’s policy decision and press conference on Wednesday. Rates are expected to stay unchanged. The key questions will likely be about Powell’s views on the outlook for growth and inflation, especially given that inflation expectations have moved sharply higher (see chart). Other key data and events next week include US ISM Services (Monday) and consumer credit (Wednesday). In the UK the BoE policy decision and press conference is due on Thursday. A handful of markets are closed on Monday for public holidays. Please see below for a full list of upcoming data and events.

Key chart: Expected 5 year change in inflation (University of Michigan Sentiment)

(All in London time BST)

Events: Certain markets closed on Monday (UK, Japan, China, others) for the May Day Bank Holiday/Labour Day.

Data: US ISM services PMI (Apr, 3pm).

Earnings: Berkshire Hathaway, Palantir.

Events: N/A

Data: Chinese Caixin service sector PMI (Apr, 2:45am).

Earnings: AMD, AXA.

Events: Fed policy decision (7pm) followed by press conference (7:30pm)

Data: Eurozone retail sales (Mar, 10am).

Earnings: Uber Tech, Walt Disney.

Events: Bank of England policy decision & minutes (12pm).

Data: German industrial production (Mar, 7am).

Earnings: N/A

Events: N/A

Data: Chinese imports, exports & trade balance (Apr, 4am).

Earnings: N/A

Monthly Global Asset Allocation No. 63, 29th April 2025:

“Strategic Portfolio: (continue to) ADD Risk”

The risk reward associated with staying defensive in strategic portfolios has diminished over recent months. In particular, there’s been a bearish shift in both market pricing and the consensus narrative, with many expecting a US recession (i.e. much is already in the price).

There is, however, a strong argument that the US will avert recession (or, at worst, experience a technical & short-lived recessionary/tariff-related shock). With the US market having fallen over 20% from its highs to its lows, much of that is already priced. In Europe, meanwhile, the ECB continues to cut rates, and the cyclical upswing is emerging. In the near term, therefore, growth prospects are better in Europe than in the US. That attractiveness is enhanced by Europe’s sector composition and its relatively more attractive valuation.

Events: N/A

Data: Canada S&P service sector PMI (April final estimate, 2:30pm); US S&P service sector PMIs (April final estimate, 2:45pm); US ISM services PMI (Apr, 3pm).

Earnings: Berkshire Hathaway, Palantir, Vertex, Williams

Events: N/A

Data: US trade balance (Mar, 1:30pm).

Earnings: AMD, Arista Networks, Duke Energy, Constellation Energy, Zoetis Inc

Events: Fed policy decision (7pm) followed by press conference (7:30pm).

Data: US consumer credit (Mar, 8pm).

Earnings: Uber Tech, Walt Disney, Arm, Applovin, DoorDash, Fortinet

Events: N/A

Data: US nonfarm productivity & unit labour costs (Q1 first estimate, 1:30pm); US weekly jobless claims (1:30pm); US wholesale sales & inventories (Mar, 3pm); US New York Fed 1 year inflation expectations (Apr, 4pm).

Earnings: ConocoPhillips, MercadoLibre, McKesson.

Events: Speeches by the Fed’s Williams, Kugler & Barr in Reykjavik (11-4pm) & Waller on a panel at Hoover Institution (4:30pm).

Data: Canadian employment data (change in employment, unemployment rate & participation rate, for Apr, due 1:30pm).

Earnings: N/A

Fig B: US ISM services PMI (headline index)

Events: N/A

Data: Eurozone Sentix investor confidence (May, 9:30am).

Earnings: N/A

Events: Speech by the ECB’s Panetta in Milan (8am)

Data: French industrial & manufacturing production (Mar, 7:45am); Spanish unemployment rate (Apr, 8am); HCOB manufacturing sector PMIs for Spain (8:15am), Italy (8:45am), France (8:50am), Germany (8:55am) & EZ (9am) - all April final estimates apart from Spain & Italy; Eurozone PPI (Mar, 10am).

Earnings: AXA, Intesa Sanpaolo, Ferrari

Events: N/A

Data: German factory orders (Mar, 7am); French private sector payrolls (Q1 first estimate, 7:45am); French trade balance (Jan, 7:45am); HCOB construction sector PMI for Germany (Apr, 8:30am); Italian retail sales (Mar, 10am); Eurozone retail sales (Mar, 10am).

Earnings: UniCredit

Events: Riksbank policy decision (8:30am).

Data: German industrial production (Mar, 7am); German imports/exports, & trade balance (Jan, 7am); Spanish industrial production (Mar, 8am).

Earnings: Enel

Events: Speech by the ECb’s Simkus in Reykjavik (8:45am).

Data: Italian Industrial production (Mar, 9am).

Earnings: N/A

Fig C: German industrial production (Y-o-Y %)

Events: Markets closed for May bank holiday

Data: N/A

Earnings: N/A

Events: N/A

Data: New car sales (Mar, 9am); S&P service sector PMI (April final estimate, 9:30am).

Earnings: N/A

Events: N/A

Data: S&P construction sector PMI (Apr, 9:30am).

Earnings: N/A

Events: Bank of England policy decision & minutes (12pm), followed by press conference (12:30pm)

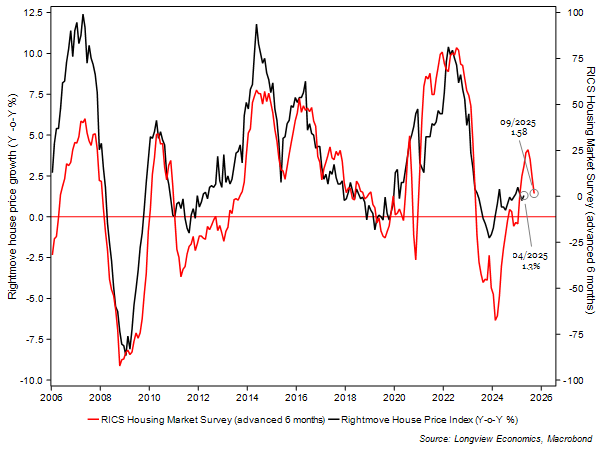

Data: RICS house price balance (Apr, 12:01am).

Earnings: N/A

Events: N/A

Data: N/A

Earnings: N/A

Fig D: UK RICS house price balance (index, 6 months advanced) vs. Rightmove house prices (Y-o-Y %)

Events: Market holiday in Japan & China on account of Labor Day.

Data: Australian S&P services sector PMI (April final estimate, 12am); Australian headline CPI (Apr, 2am); Australian ANZ-Indeed job advertisements (Apr, 2:30am).

Earnings: Westpac Banking

Events: RBNZ published financial stability report (10pm).

Data: Australian building approvals & private sector houses (Mar, 2:30am); Australian household spending (Mar, 2:30am); Chinese Caixin service sector PMI (Apr, 2:45am).

Earnings: Commonwealth Bank of Australia

Events: N/A

Data: Japanese Jibun Bank services sector PMI (April final estimate, 1:30am).

Earnings: SoftBank Corp, Japan Tobacco, National Australia Bank

Events: BOJ minutes of March meeting (12:50am).

Data: N/A

Earnings: Mitsubishi Heavy Industries, Takeda Pharmaceutical, Panasonic, ANZ Holdings.

Events: N/A

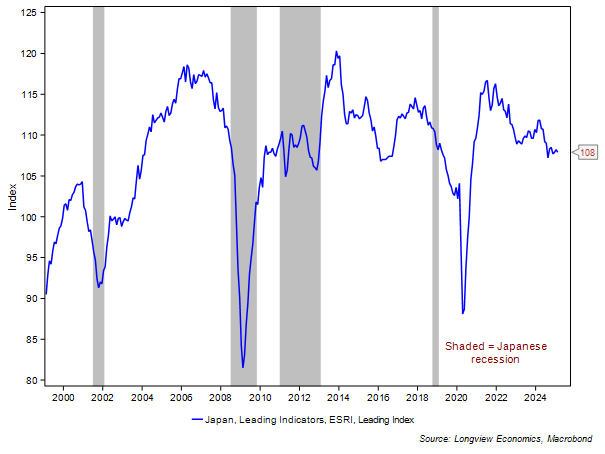

Data: Japanese household spending (Mar, 12:30am); Chinese imports/exports, & trade balance (Apr, 4am); Japanese ESRI leading index (March first estimate, 6am).

Earnings: Nippon Telegraph & Telephone, Honda Motor, Mitsui Fudosan

Fig E: Japanese ESRI leading index shown with recession bands

Longview on Friday, 2nd May 2025:

“Tariffs: What's Priced In?”

Tactical Equity Asset Allocation No. 256, 1st May 2025 :

“Bearishness Abounds’ a.k.a. Stay Tactically LONG –> Trim Position Size”

Longview Letter No. 148, 30th April 2025:

“UK: Boom First -> IMF Bailout Later? a.k.a. How to Fix the Economy, Part III”

Monthly Global Asset Allocation No. 63 29th April 2025:

“Strategic Portfolio: (continue to) ADD Risk”

Recommended Global Macro Trade, 28th April 2025:

“Move SHORT Gold (BUY a Put Spread)”

Longview on Friday, 25th April 2025:

“Tactical Equity Timing: Liberation Day Resistance Levels Looming – What’s Next? PLUS America’s ‘Exorbitant Privilege’ Revisited (All is Not What It Seems)”

Monthly Global Asset Allocation No. 62 24th April 2025:

“Start Moving OW Risk in Strategic Portfolio A.k.a. Add to HY Credit Weightings”