The State of Markets

A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

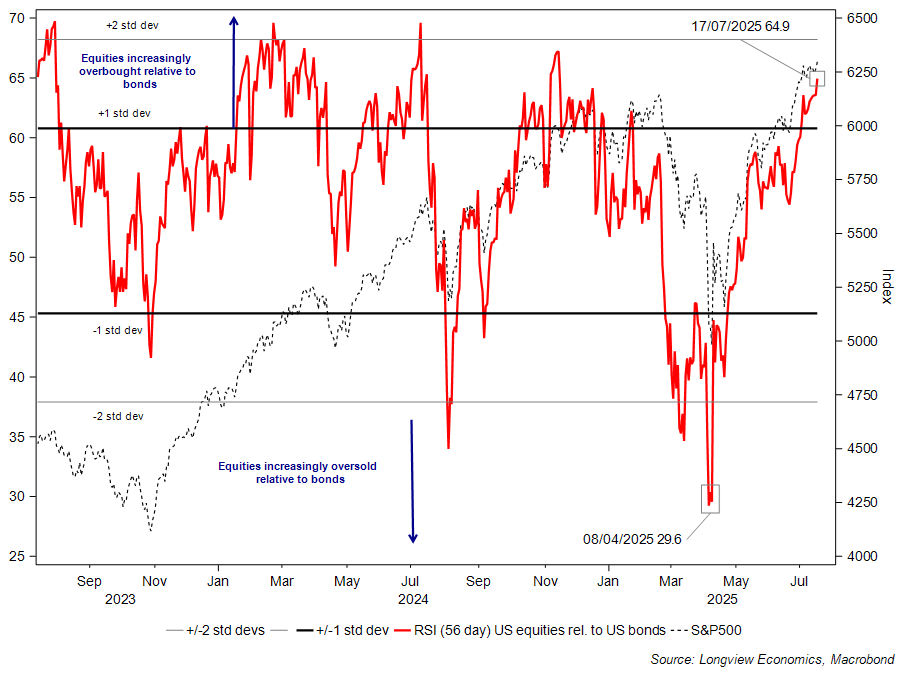

The State of Markets: "Equities Overbought (Relative to Bonds)"

By Thursday’s close key US markets were eking out small gains for the week. The S&P500 was 0.6% higher on the week; the Dow Jones was up by 0.3%; while the NDX100 had fared better (+1.3%). By half way through the session on Friday, those markets were modestly lower (basically flat). US earnings, which began in earnest this week, have been a key factor pushing markets, and single names, higher. Key banks have been mostly beating expectations, along with high profile stocks like Netflix. With that (modest) strength in the S&P500 and NDX100, both markets have (just) broken out to the upside of their recent multi week trading ranges (i.e. from the first half of July).

Equities, though, are notably overbought relative to bonds (see chart below). In recent quarters, that’s been an effective indication that the equity rally is due a ‘breather’ (or indeed ‘some giveback’). The BAML FMS this week appeared to confirm that sense (i.e. ‘the market is due a breather’), reporting that there has been: ‘a record surge in risk appetite in the past 3 months’ (source: BAML FMS, July 2025).

Next week, the US quarterly earnings season continues with a large number of companies reporting. Key features include earnings from Alphabet and Tesla (both Wednesday); an ECB policy meeting (Thursday), which will be preceded by the ECB Bank lending survey (i.e. credit conditions on Tuesday). Elsewhere there’s a housing theme in the US with both existing home sales and new home sales out this week (Wed & Thurs). In the UK, it’ll be all eyes on the public finances data update, due Tuesday (given the concern about a potential UK fiscal crisis). Flash PMIs from across the globe will also be watched closely (on Thursday).

Key Chart: Medium term RSI (equities relative to bonds) vs. S&P500

(All in London time BST)

Events: China policy decision (2am).

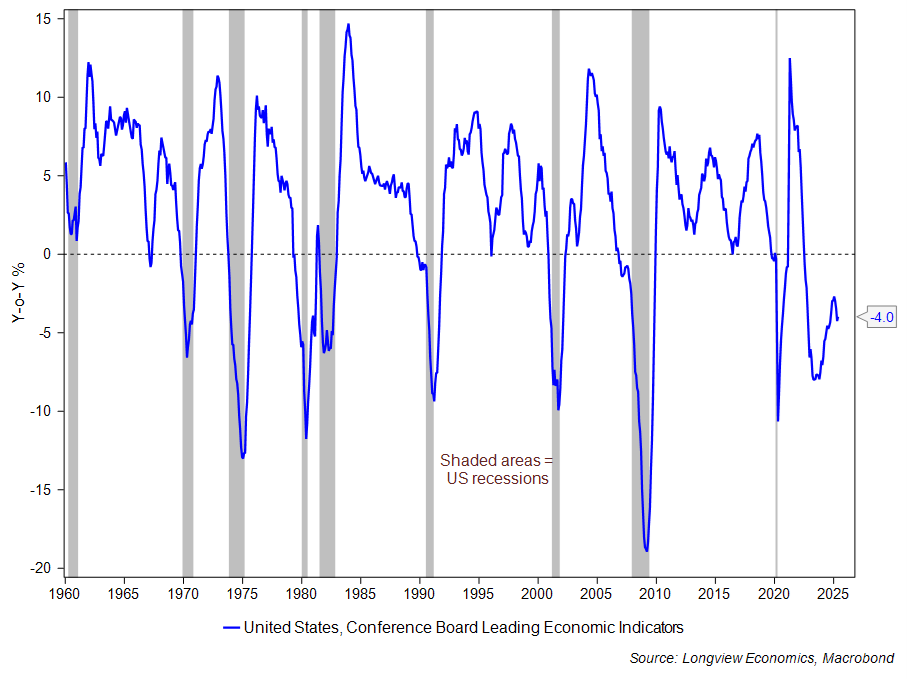

Data: US Conference Board leading index (June, 3pm).

Earnings: N/A

Events: ECB Bank Lending Survey (9am).

Data: UK Public sector finances (June, 7am).

Earnings: Coca-Cola, Philip Morris, Texas Instruments

Events: speech by BOJ Deputy Governor Uchida in Kochi (2:30am).

Data: US existing home sales (June, 3pm); Eurozone consumer confidence (July first estimate, 3pm).

Earnings: Alphabet, Tesla, T-Mobile US, IBM.

Events: ECB policy decision (1:15pm) followed by Lagarde press conference.

Data: Manufacturing & service sector PMIs for Australia (12am), Japan (1:30am), France (8:15am), Germany (8:30am), Eurozone (9am), UK (9:30am) & US (2:45pm) – all July first estimates.

Earnings: SK Hynix Inc, Blackstone, Honeywell, BNP Paribas, Lloyds Bank

Events: N/A

Data: Eurozone M3 money supply, including monthly loans to businesses and households (July, 9am); US durable goods orders (June first estimate, 1:30pm).

Earnings: N/A

Global Macro Report, 15th July 2025:

“Britain → Due a Credit Boom ”

The pre-conditions for a UK credit boom are in place: i) Household borrowing capacity is high (from both a balance sheet and a debt serviceability perspective); ii) banks profitability has stepped up since late 2022, and capital ratios are high; while iii) policy rates, and therefore loan rates, are set to fall further over coming months.

Risks to the thesis, as always, are multiple and include: i) the risk that inflation remains sticky (and policy rates are not cut further), as well as ii) the risk of a fiscal crisis (engendered by poor fiscal management by the current UK government).

Events: Fed's external communications blackout begins; Bank of Canada business outlook future sales (3:30pm).

Data: US Conference Board leading index (June, 3pm).

Earnings: Verizon, Roper Technologies, NXP

Events: Fed's Powell gives welcome remarks at regulatory conference (1:30pm).

Data: US Philadelphia Fed business outlook (July, 1:30pm); US Richmond Fed manufacturing index (July, 3pm).

Earnings: Coca-Cola, Philip Morris, Rtx Corp, Texas Instruments, Intuitive Surgical, Danaher, Chubb, Lockheed Martin, Sherwin-Williams, Capital One Financial, Northrop Grumman, General Motors, PACCAR

Events: N/A

Data: US existing home sales (June, 3pm).

Earnings: Alphabet, Tesla, T-Mobile US, IBM, ServiceNow Inc, AT&T, Thermo Fisher Scientific, NextEra Energy, GE Vernova LLC, Boston Scientific, Amphenol, CME Group, Fiserv, Moody’s, General Dynamics, O’Reilly Automotive, Chipotle Mexican Grill, Hilton Worldwide, Waste Connections, Freeport-McMoran, CSX

Events: N/A

Data: Canadian retail sales (May, 1:30pm); US weekly jobless claims (1:30pm); Chicago Fed national activity (June, 1:30pm) US S&P manufacturing & service sector PMIs (July first estimates, 2:45pm); US new home sales (June, 3pm); US Kansas City Fed manufacturing sector activity (July, 4pm).

Earnings: Blackstone, Honeywell, Union Pacific, Intel, Loblaw Companies, Newmont Goldcorp, Digital, Nasdaq Inc

Events: N/A

Data: US durable goods orders (June first estimate, 1:30pm); US Kansas City Fed service sector activity (July, 4pm).

Earnings: HCA, Aon, Charter Communications

Fig B: US Conference Board Leading Index (Y-o-Y %)

Events: N/A

Data: N/A

Earnings: N/A

Events: ECB Bank Lending Survey (9am)

Data: French retail sales (June).

Earnings: UniCredit

Events: N/A

Data: Eurozone consumer confidence (July first estimate, 3pm).

Earnings: Equinor, Iberdrola, Thales.

Events: ECB policy decision (1:15pm) followed by Lagarde press conference (1:45pm).

Data: Eurozone new car sales (June, 5am); German GfK consumer confidence (Aug, 7am); Spanish PPI (June, 8am); Spanish unemployment rate (Q1, 8am); HCOB manufacturing & service sector PMIs for France (8:15am), Germany (8:30am) & Eurozone (9am) – all July first estimates.

Earnings: TotalEnergies SE, BNP Paribas

Events: ECB Survey of Professional Forecasters (9am).

Data: French INSEE consumer confidence (July, 7:45am); German IFO business climate (July, 9am); Eurozone M3 money supply (July, 9am); Italian ISTAT consumer & manufacturing confidence (July, 9am).

Earnings: N/A

Fig C: Eurozone consumer confidence (index)

Events: N/A

Data: UK Rightmove house prices (July, 12:01am).

Earnings: N/A

Events: N/A

Data: Public sector finances (June, 7am).

Earnings: N/A

Events: N/A

Data: N/A

Earnings: N/A

Events: N/A

Data: S&P manufacturing & service sector PMIs (July first estimates, 9:30am); CBI industrial trends survey (June, 11am).

Earnings: Relx, Lloyds Banking

Events: N/A

Data: Gfk consumer confidence (July, 12:01am); Retail sales (June, 7am).

Earnings: N/A

Fig D: UK S&P manufacturing & service sector PMIs

Events: China policy decision (2am); market holiday in Japan on account of Marine Day.

Data: N/A

Earnings: N/A

Events: RBA minutes from July policy meeting (2:30am).

Data: N/A

Earnings: N/A

Events: Speech by BOJ Deputy Governor Uchida in Kochi (2:30am)

Data: Australian Westpac leading index (June, 1:30am); Japanese machine tool orders (May final estimate, 7am).

Earnings: Samsung Biologics

Events: speech by the RBNZ's Conway on tariffs & the economy (2:30am); speech by the RBA’s Bullock (4:05am).

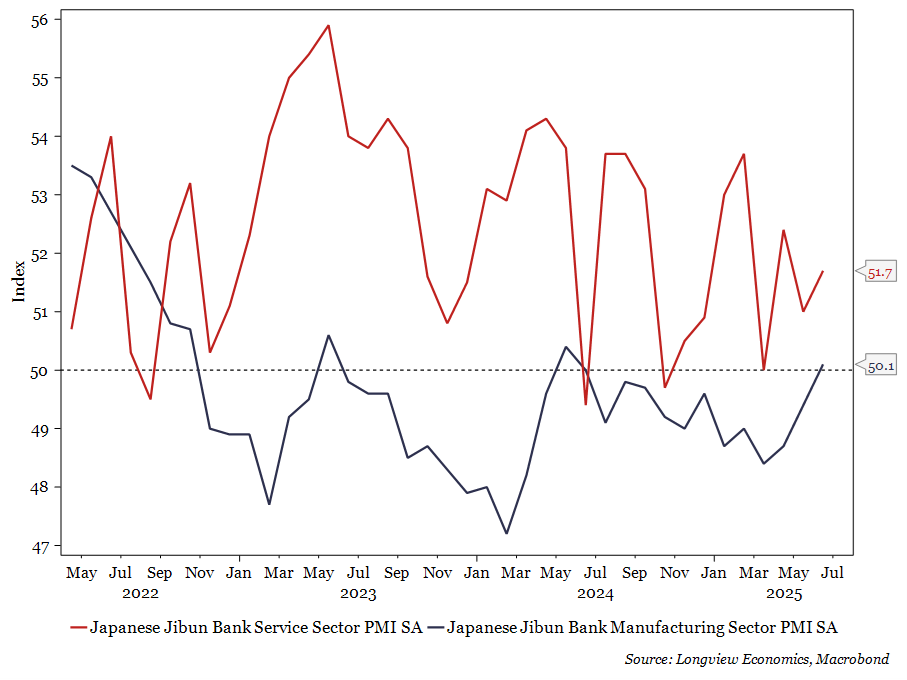

Data: Australian S&P manufacturing & services sector PMIs (July first estimates, 12am); Japanese Jibun Bank manufacturing & services sector PMIs (July first estimate, 1:30am).

Earnings: SK Hynix Inc

Events: N/A

Data: Japanese ESRI leading index (May final estimate, 6am).

Earnings: N/A

Fig E: Japanese Jibun Bank manufacturing & services sector PMIs

Longview on Friday, 17th July 2025:

“Where to Allocate -> US & EZ Small/Mid-Caps vs. Large Caps; PLUS UK Labour Market –> How Bad Is It?”

Global Macro Report, 15th July 2025:

“Britain – Due a Credit Boom”

Daily Dose of Macro & Markets this week:

Daily Dose of Macro & Markets 18th July 2025:

“Britain – Is There Any Hope?”

Daily Dose of Macro & Markets 17th July 2025:

“The Next China Shock”

Daily Dose of Macro & Markets 16th July 2025:

“US Inflation: ‘Something for Everyone’”

Daily Dose of Macro & Markets 16th July 2025:

“Fiscal Crisis?”

Weekly Risk Appetite Gauge:

'Weekly Risk Appetite Gauge', 14th July 2025:

“Consolidating? Or Rolling Over?”

Longview on Friday, 11th July 2025:

“Small & Midcap Equity Indices: US vs. Europe”

Longview 'Tactical' Alert No. 92, 10th July 2025:

“Remain ‘Tactically’ Cautious Equities: Summer Turbulence Ahead”

The SHORT VIEW (& market positioning), 8th July 2025:

“SELL YEN (& BUY USD, EUR or CHF)”