The State of Markets

A brief review of all key upcoming events across the major regions of the globe & an overview of key recent market trends.

The State of Markets: “Trump Clean Sweep – All Change”

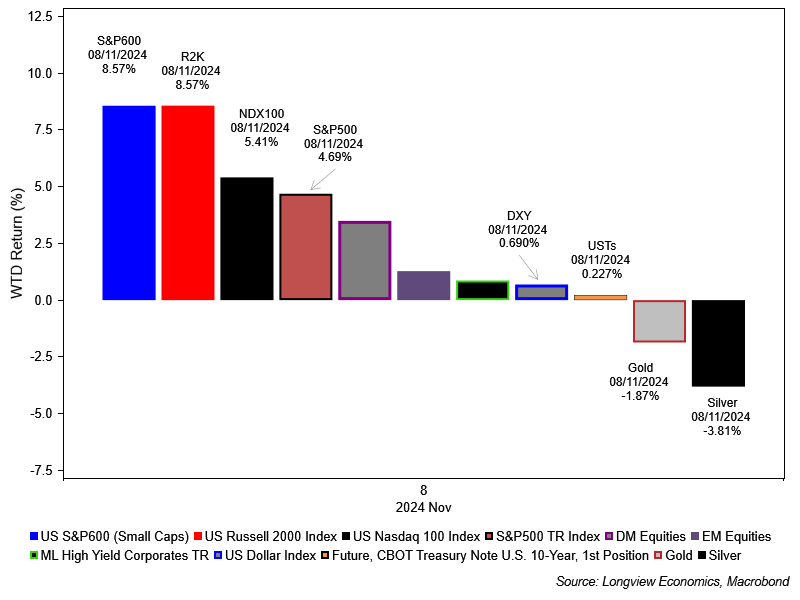

A surprise election result overnight Tuesday generated some dramatic price swings over the course of last week. Trump and the Republican’s (likely) clean sweep of the Presidency, the Senate, and the House of Representatives (yet to be finally called) was a surprise to almost all election forecasters (who expected a very ‘tight race’). As a result, asset prices shifted sharply over the course of the week. The US small and mid-cap indices rose dramatically (closing the week up 8.6%); the main US large cap equity indices also performed well (NDX100 & S&P500); while, perhaps surprisingly for the bond vigilantes, US Treasuries were largely unchanged on the week (with US 10-year yields, for example, closing on Friday at 4.30% versus 4.37% yield on the prior Friday). The dollar also ended the week largely unchanged, while gold & silver were both down sharply (after strong bull runs in recent months) – see chart below.

The clean sweep will usher in a new economic agenda, which will have both positives and negatives. From the stock market’s perspective, Trump’s agenda will be deregulatory, will ease up on banks’ capital and regulatory regime, and will include fiscal stimulus/lower corporate tax rates. On the negative side, a stronger tariffs regime is about to be introduced. In this week’s ‘Longview from London’ (available on Substack

Next week remains busy (although it’s unlikely to be as dramatic as last week!). The focus will be on US consumer price inflation (on Wednesday). US producer price inflation is also released next week (Thursday); while there’s a China theme to the global macro data (with Chinese monthly lending, retail sales, new home prices, fixed asset investment and so on, published during the week). Elsewhere the Fed publishes its latest ‘Senior Loan Officers’ Survey’ (with an update on the state of credit conditions), while in the UK the Chancellor will deliver the annual Mansion House speech (on Thursday evening). Fed’s Powell & Williams will also both be speaking on Thursday (post last week’s Fed meeting). For a full list of next week’s events (in summary and by key region) please see below.

Key chart: Weekly performance (% return) – various key assets

(All in London time BST)

Events: N/A

Data: N/A

Earnings: N/A

Events: N/A

Data: US NFIB small business optimism (Oct, 11am); UK employment, jobless claims & average weekly earnings (Sept/Oct, 7am).

Earnings: Home Depot, AstraZeneca.

Events: N/A

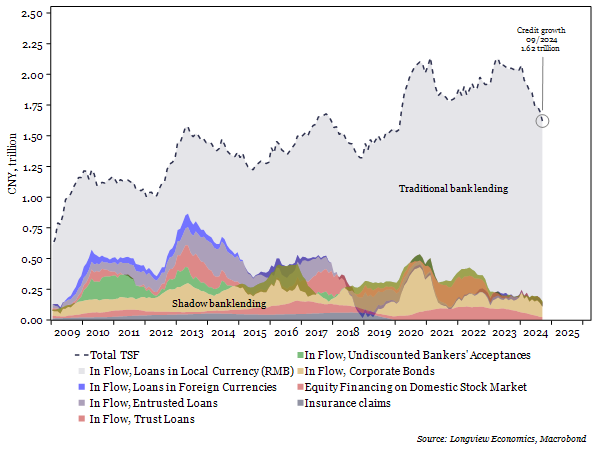

Data: US headline & core CPI (Oct, 1:30pm); Chinese total social financing, new yuan loans, and M0, M1 & M2 money supply – (Oct, time tentative).

Earnings: Cisco.

Events: Speech by the Fed’s Powell at event in Dallas (8pm); speech by the Bank of England’s Bailey at the annual financial and professional services dinner (9pm); UK Chancellor Reeves gives Mansion House speech (Thurs evening).

Data: US headline & core PPI (Oct, 1:30pm).

Earnings: Walt Disney, Applied Materials.

Events: N/A

Data: Chinese new & used home prices (Oct, 1:30am); Chinese activity data (Oct, 3am); US retail sales (Oct, 1:30pm).

Earnings: N/A

Monthly Global Asset Allocation No. 53, 5th November 2024:

“BUY Bonds -> Pain Trade Ahead A.k.a. Move OW US Treasuries (from NEUTRAL)”

US Treasuries have sold off sharply in recent weeks. In particular, the 10 year yield has risen sharply from 3.63% to 4.31% in the past 8 weeks, and is now above its 200 day moving average. There are a number of good reasons for that move. US macro data, for example, has been better than expected (see the Citi surprise index) and the rates market has therefore priced out some of the Fed cuts (i.e. 85bps worth of cuts by year end 2025).

Events: N/A

Data: N/A

Earnings: N/A

Events: Speeches by the Fed’s Waller at Banking conference (3pm), Barkin in Baltimore (3:15pm), Harker on fintech and AI (10pm) & Barkin at Salisbury-Wicomico Economic Development (10:30pm).

Data: US NFIB small business optimism (Oct, 11am); Canadian building permits (Sept, 1:30pm); US New York Fed 1 year inflation expectations (Oct, 4pm); US Senior Loan Officer Opinions survey (Tues, 7pm).

Earnings: Home Depot, Occidental.

Events: Speeches by the Fed’s Logan at Energy conference (2:45pm), Musalem on the Economy and monetary policy (6pm) & Schmid at Energy conference (6:30pm).

Data: US headline & core CPI (Oct, 1:30pm); US monthly budget statement (Oct, 7pm).

Earnings: Cisco, Copart.

Events: The Fed’s Barkin discusses the Economy in Fireside chat (2:15pm), speeches by Powell at event in Dallas (8pm) & Williams at NY Fed event (9:15pm).

Data: US headline & core PPI (Oct, 1:30pm); US weekly jobless claims (1:30pm).

Earnings: Walt Disney, Applied Materials, Palo Alto Networks, Ross Stores.

Events: N/A

Data: Canadian manufacturing & wholesale sales (Sept, 1:30pm); US Empire manufacturing (Nov, 1:30pm); US retail sales (Oct, 1:30pm); US import & export price index (Oct, 1:30pm); Canadian existing home sales (Oct, 2pm); US industrial & manufacturing production & capacity utilisation (Oct, 2:15pm); US business inventories (Sept, 3pm).

Earnings: N/A

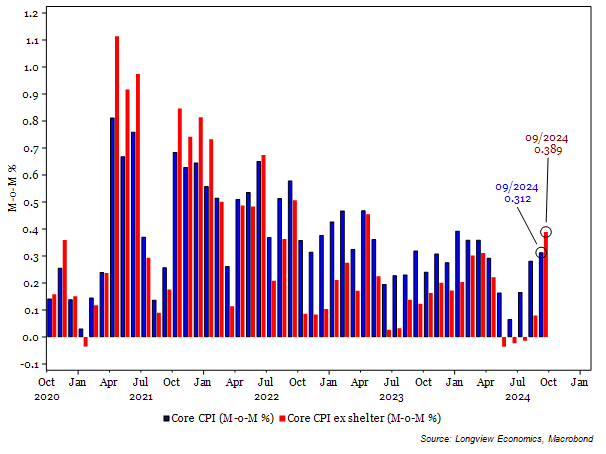

Fig B: US core CPI ex. shelter (M-o-M%)

Events: N/A

Data: N/A

Earnings: N/A

Events: Speeches by the ECB’s Rehn at UBS European Conference 2024 (8am), Centeno at a conference about Portugal's economic development (9am) & Cipollone on financial sanctions at Global Research Forum (2pm).

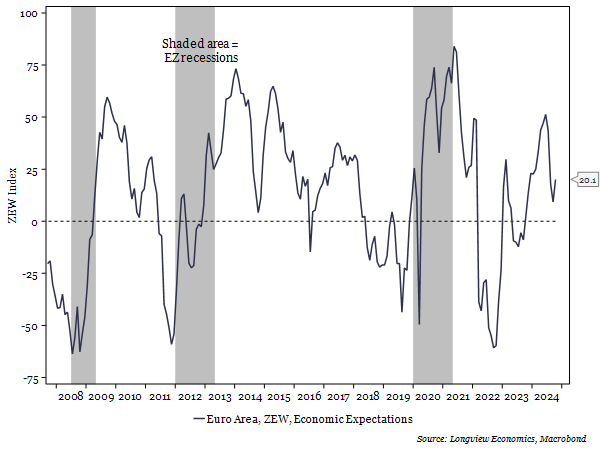

Data: German headline CPI (October final estimate, 7am); German & Eurozone ZEW survey – expectations & current situation (Nov, 10am).

Earnings: N/A

Events: Riksbank minutes from November published (8:30am).

Data: French unemployment rate (Q3, 6:30am); Eurozone industrial production (Sept, 10am).

Earnings: N/A

Events: Speech by the ECB’s Schnabel in Washington (6:30pm); Chancellor gives mansion House speech.

Data: Spanish headline & core CPI (October final estimate, 8am); Eurozone GDP (Q3 second estimate, 10am); Eurozone employment (Q3 first estimate, 10am).

Earnings: N/A

Events: Speeches by the ECB’s Lane at seminar `A Fragmenting Trading System: where we stand and implications for policy' (3pm) & Cipollone at CER Ditchley Park conference (3:15pm).

Data: French headline & core CPI (October final estimate, 7:45am); Italian general government debt (Sept, 9:30am).

Earnings: Assicurazioni Generali.

Fig C: Eurozone ZEW survey - expectations (index)

Events: N/A

Data: N/A

Earnings: N/A

Events: N/A

Data: Employment, jobless claims & average weekly earnings (Sept/Oct, 7am).

Earnings: AstraZeneca.

Events: Speech by the Bank of England’s Mann at BNP Paribas’ Global Markets Conference (9:45am).

Data: N/A

Earnings: N/A

Events: Speech by the Bank of England’s Bailey at the annual financial and professional services dinner (9pm).

Data: RICS house price balance (Oct, 12:01am).

Earnings: 3I Group.

Events: N/A

Data: Monthly GDP estimate, industrial & manufacturing production, goods trade balance & construction output (Sept, 7am).

Earnings: N/A

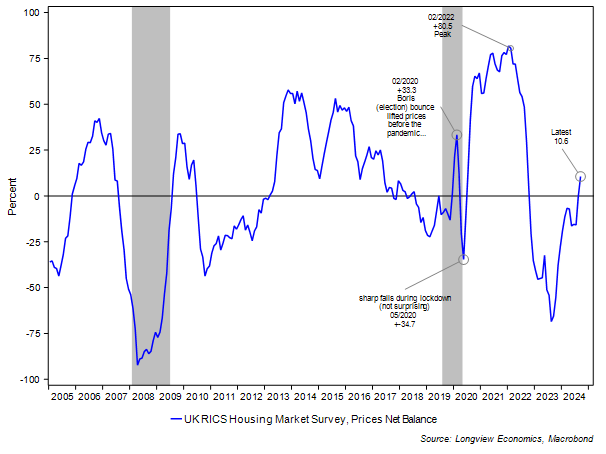

Fig D: UK RICS house price balance (index)

Events: N/A

Data: Australian Westpac consumer confidence (Nov, 11:30pm); Japanese M2 & M3 money supply (Oct, 11:30pm).

Earnings: Recruit Holdings.

Events: N/A

Data: Australian NAB business confidence (Oct, 12:30am); Japanese machine tool orders (October first estimate, 6am); Japanese PPI (Oct, 11:50pm).

Earnings: SoftBank Group Corp, Tokyo Electron, Commonwealth Bank of Australia.

Events: N/A

Data: Australian wage price index (Q3, 12:30am); Chinese total social financing, new yuan loans, and M0, M1 & M2 money supply – (Oct, time tentative).

Earnings: Aristocrat Leisure.

Events: N/A

Data: Australian consumer inflation expectations (Nov, 12am); Australian employment change (Oct, 12:30am); Japanese GDP (Q3 second estimate, 11:50pm).

Earnings: Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial, Mizuho Financial.

Events: Speech by the RBA’s Bullock at the ASIC Annual Forum (Fri, 12:30am).

Data: Chinese new & used home prices (Oct, 1:30am); Chinese activity data (industrial production, retail sales, fixed asset, property investment & unemployment rate – Oct, 3am).

Earnings: N/A

Fig E: Chinese total social financing (CNY, trillion)

Longview on Friday, 8th November 2024:

“Regime Shifts, Trump & Risks to the Bull Case”

Longview ‘Tactical’ Alert No. 86, 6th November 2024:

“Move Tactically Overweight Equities A.k.a. Expected Republican ‘clean sweep’ is stock market & growth friendly”

Tactical Equity Asset Allocation No. 250, 5th November 2024:

“Markets (& Models) -> Primed A.k.a. Awaiting Election Outcome”

Monthly Global Asset Allocation No. 53, 5th November 2024:

“‘BUY Bonds -> Pain Trade Ahead A.k.a. Move OW US Treasuries (from NEUTRAL)”

Longview on Friday, 1st November 2024:

“Equities, Bonds, & The US Election”

Global Macro Report, 31st October 2024:

“UK Losing Fiscal Discipline: Does it Change the Macro Theme?”

The SHORT VIEW (& market positioning), 29th October 2024:

“‘US Election Trades’ – Overcooked?”