Trump 2.0 vs. 1.0 –> What’s Different? What Matters for Markets? Is Europe Finally Having its Day (in the Sun)? PLUS the View from Sweden

Trump 2.0 vs. Trump 1.0 –> Key Differences & Why It Matters

By Chris Watling, Global Economist & Chief Market Strategist, Longview Economics

Markets, as widely predicted last year, are grappling with the unpredictability of Trump policy making ‘on the hoof’. Already multiple Executive Orders, prepared comments/speeches (e.g. to Davos re oil & OPEC), and throwaway remarks are driving market volatility.

The question, though, is what are the guardrails? What really matters? And will Trump 2.0 be similar to 1.0?

As we started laying out last week, the US economy is in a notably different position in 2025 relative to 2016/17: i) The starting fiscal deficit is ~7% of GDP (vs. 2% in 2016 – fig 2); ii) there's a soft underbelly to US growth (as a result of tight monetary policy for the past 3 years - see our Quarterly Global Asset Allocation update published on 18th December 2024: ‘US Mid Cycle Slowdown Expected (2025)’); while iii) the S&P500 is 2 ¼ years into a bull run without a significant break in its uptrend (i.e. since Oct 2022 –> versus 10 months into a new bull phase by Jan 2017), with that; iv) the index is close to record high valuations (at 21/22x forward EPS, versus 17x in 2017).

That is a different backdrop to 2016/2017.

Fig 1: Trump 1.0 –> Order of key economic policy implementation

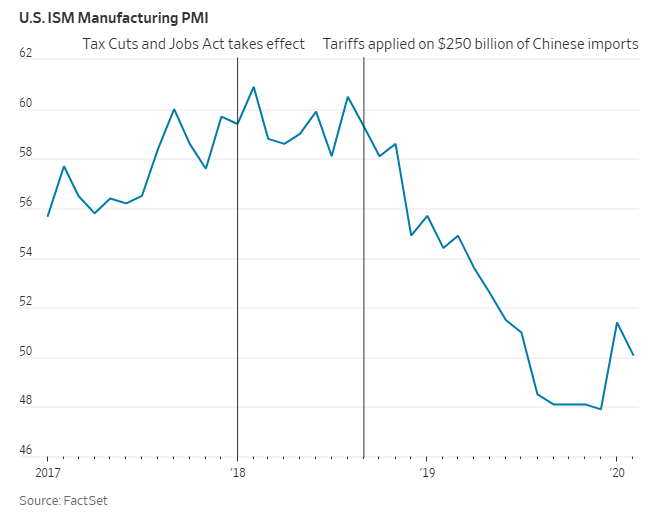

Furthermore, in 2017, the order of 'policy' implementation was different (e.g. see fig 1 above sourced from WSJ). First it was fiscal stimulus (agreed over the course of 2017); and then in 2018 the tariffs began (initially with trivial amounts/and then later in the year, Trump put tariffs on $250bn of Chinese goods - see fig 1).

This time tariffs are likely to be one of the first key economic policies (along with shrinking government spending, as the DOGE gets to work); while fiscal is probably going to take all/much of the year to negotiate (with its full effects eventually not felt until later this year/2026).

Furthermore, given the 7% starting deficit vs. 2% in 2016/17, there's considerable pushback from within the Republican party about unfunded tax cuts.

Keep reading with a 7-day free trial

Subscribe to The (Long)View From London to keep reading this post and get 7 days of free access to the full post archives.